Dear Friends of the University of California, Irvine School of Law’s Graduate Tax Program,

The UCI Law Graduate Tax Program welcomed its fifth cohort of 10 amazing tax students this fall to the UCI family. This new class of students includes four UCI Law J.D. graduates, a veteran and two international students from South Korea.

We started off the academic year hosting our orientation reception in the courtyard of Rutan & Tucker, where our tax mentors, tax professors and tax practitioners met with our new UCI Graduate Tax Program cohort (pictured right).

We’ve already had an exciting few months of programming for our students including the UCI/IFA Careers in Tax Roundtable and networking events. We’re off to a great start and looking forward to a fantastic spring semester.

Sincerely,

Natascha R. Fastabend

Executive Director,

UCI Law Graduate Tax Program

Did you know?

- The UCI Law Graduate Tax Program is ranked No. 1 on the West Coast and No. 5 nationwide among law schools with a graduate tax program on TaxProf Blog.

- Our founding professors were named in the Top 50 most downloaded U.S. Tax Law Professors on SSRN. Prof. Fleischer ranked No. 24, Prof. Marian ranked No. 28, and Prof. Blank ranked No. 34.

- Our tax program has maintained a 100 percent employment rate for post-graduate students for FOUR consecutive years!

- Our alumni practice tax law in many major cities throughout the United States in the tax profession, including major accounting firms, law firms and governmental entities, including the IRS Office of Chief Counsel and the United States Tax Court.

- Our website contains resources about the intersection of tax law and racial inequity. It also showcases academic research, stories from popular media outlets, blog posts, podcasts, and personal testimony.

Welcoming New Adjunct Professors Spring 2024

Steven Wrappe, Transfer Pricing Technical Leader at Grant Thornton in its Washington D.C. National Tax Office.

Steve is a globally-recognized transfer pricing expert, with over 25 years of experience in transfer pricing planning, compliance and controversy for large multinational clients. During that time, he has been a Senior Attorney with the IRS Advance Pricing Agreement (APA) Program, a partner with a global law firm, and the transfer pricing controversy leader at Big Four Firms.

Robert Russell, Senior Counsel of Corporate and Tax at Rutan & Tucker, to teach our Graduate Tax Program Externship class.

Robert represents businesses and individuals in a wide-range of tax matters. He provides tax planning, tax controversy and transactional tax services with a specialty on cross-border tax issues.

Robert has extensive experience in both domestic and international business transactions, including entity structuring, mergers and acquisitions, and financing transactions. He also assists with tax planning for U.S. residents and nonresident alien individuals and business for U.S. tax issues related to foreign entities, assets, trusts, foreign tax credits, transfer pricing and digital currency.

Alumni News

UCI Law Graduate Tax Program’s Andres Berdugo ’23 Named 2023 Tax Notes Student Writing Competition Winner

We’re proud to announce that Andres Berdugo (’23), a recent LL.M. graduate of the UCI Law Graduate Tax Program, was named the winner of the 2023 Tax Notes Student Writing Competition for his article titled, “Form Follows Function: A Critical Analysis and Reassessment of the Continuity of Business Enterprise Doctrine.”

The annual student writing competition recognizes superior student writing on unsettled questions in federal, state, or international tax law or policy.

Events

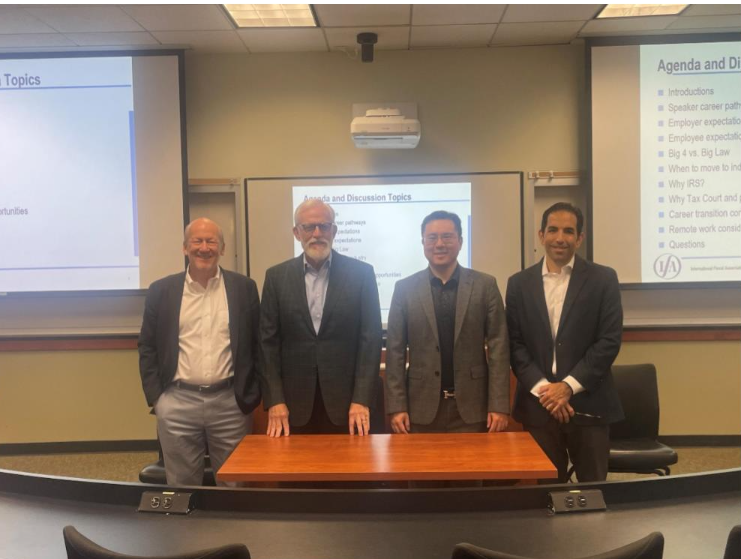

Second Annual IFA Careers in Tax Roundtable

The International Fiscal Association (IFA) and UCI Graduate Tax Program hosted its annual roundtable on alternative pathways for those considering or starting careers in tax. We had representatives from the Big-4, Big Law, Industry and the IRS.

- Presenters include (pictured left to right):

- Michael Lebovitz, Partner, Eversheds Sutherland

- John Deshong, Vice President Global Tax, Bechtel Group

- Kevin Ma, Partner, Ernst & Young

- Jimeel Hamud – Associate Area Counsel, IRS Office of Chief Counsel

Tax Career Day

The UCI Graduate Tax Program welcomed various employers to campus (virtually and in-person) for Tax Career Day on October 20. Graduate Tax Program students were interviewed for Spring 2024 externships and full-time post-graduate employment opportunities. We were thrilled to host the following participants:

The UCI Law Graduate Tax Program encourages employers to meet their tax-hiring needs by submitting job postings on UCI Law’s online job database.

UCI Graduate Tax Program Information Sessions

The Graduate Tax Program faculty and Executive Director host multiple informational sessions throughout the academic year. They discuss the Program’s curriculum and how it provides both the doctrinal depth and practical skills needed to practice tax law at the highest levels in the United States and abroad.

We’ve also hosted multiple information sessions this fall with various accounting firms, preparing our students for Tax Career Day, including Andersen, KPMG, EY and Deloitte.

Our upcoming info session will be held on Thursday, November 30 at 12:00 p.m. (PST). Please RSVP here and a zoom-link will be sent 24 hours in advance.

If you are interested in learning more about the program and would like to have an individual meeting with the Executive Director, please email nfastabend@law.uci.edu.

Procopio International LL.M. Networking Event

Our international Graduate Tax Program students (and LL.M. students) met with international attorneys during Procopio‘s International LL.M. Networking Event in September.

For more information on UCI Law Graduate Tax Program news & events, please visit our website.

Alumni Testimonial

Enrolling in UCI’s Graduate Tax Program has been my best academic decision. The program distinguishes itself with small class settings, world-class faculty, a highly selective cohort, and abundant networking opportunities. I gained invaluable practical experience through a tax externship at a multinational corporation. What truly sets UCI apart is its commitment to students’ post-graduate success, providing comprehensive career guidance, including resume and interview preparation, and mentor recommendations that were instrumental in securing my dream job offer. UCI’s Graduate Tax Program is not just an institution; it’s a launchpad for a prosperous career in taxation.

Siqi Chen, UCI Law Grad Tax LL.M. ’23

International Tax Associate, KPMG